Invoice Terms and Conditions Template: A Complete Guide

Every business, big or small, deals with invoices. They are more than just a way to request payment. An invoice also acts as a legal document that protects both the seller and the buyer. But what makes an invoice truly effective is the invoice terms and conditions section.

Without clear terms, misunderstandings can occur. Clients may delay payments, dispute charges, or even refuse to pay altogether. That’s where an invoice terms and conditions template becomes essential.

In this guide, we’ll explore why invoice terms matter, what to include in them, and how to create a professional template that saves time and reduces risks.

What Are Invoice Terms and Conditions?

Invoice terms and conditions are the rules and guidelines you set on your invoices. They outline important details like payment deadlines, late fees, accepted payment methods, and refund policies.

In simple words, these terms act as a mutual agreement between you and your client. They clarify expectations upfront so both parties know their responsibilities.

For example:

If your payment term is Net 30, it means the client has 30 days to pay the invoice.

If you charge a 2% late fee per month, the client knows what to expect if they miss the deadline.

Why You Need an Invoice Terms and Conditions Template

Creating a professional invoice every time can be stressful. That’s where a template comes in handy. A ready-to-use invoice terms and conditions template helps you:

Save time – No need to rewrite rules for every invoice.

Ensure consistency – All clients receive the same clear terms.

Protect your business – Legal clarity reduces disputes.

Build trust – Professional invoices make you look credible.

Improve cash flow – Clear payment terms encourage faster payments.

Think of the template as a standard blueprint you can customize depending on the client or project.

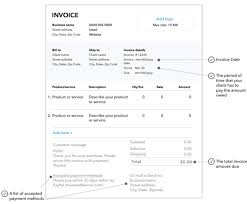

Key Elements of an Invoice Terms and Conditions Template

When drafting your template, make sure it covers all the important details. Here are the most common sections you should include:

Payment Terms

This is the most crucial part. Specify:

Due date (e.g., Net 7, Net 15, Net 30).

Accepted payment methods (bank transfer, PayPal, credit card, etc.).

Early payment discounts (e.g., 5% off if paid within 10 days).

Example:

“Payment is due within 30 days of the invoice date. We accept payments via bank transfer or credit card.”

Late Payment Policy

Late payments can harm your cash flow. Set clear rules for penalties.

Interest charges (e.g., 1.5% per month on overdue amounts).

Flat late fees (e.g., $25 per late payment).

Collection rights if payments are significantly overdue.

Example:

“A late fee of 2% per month will be applied to all overdue balances after 30 days.”

Refunds and Returns

If your business deals with products or services, refunds and returns must be addressed.

State whether refunds are available.

Mention conditions (e.g., damaged products, service dissatisfaction).

Specify timelines (e.g., refunds processed within 14 business days).

Delivery of Goods or Services

For product-based businesses, mention shipping or delivery policies.

Shipping timelines.

Responsibility for shipping costs.

Risk transfer (e.g., responsibility passes after delivery).

For service providers, clarify project timelines and deliverables.

Confidentiality Clause

If your work involves sensitive data, add a confidentiality clause. This builds client trust and protects information.

Liability Limitations

Protect yourself from unreasonable claims.

Example:

“Our liability is limited to the total amount paid for the services in this invoice.”

Governing Law

Mention which state, country, or legal system governs the agreement. This is especially important for international transactions.

Contact Information

Always include:

Business name.

Address.

Phone number.

Email.

This ensures clients know how to reach you in case of questions.

Example of an Invoice Terms and Conditions Template

Here’s a sample structure you can adapt:

Invoice Terms and Conditions Template

Payment Terms: Payment is due within 30 days of the invoice date. Accepted payment methods include bank transfer and credit card.

Late Payment: A late fee of 1.5% per month will be applied to overdue balances.Refund Policy: Refunds are available within 14 days for defective products only. No refunds for services once delivered.

Delivery: Products will be shipped within 7 business days. Risk transfers to the client upon delivery.

Confidentiality: Both parties agree to keep all business and personal data confidential.

Liability: Our liability is limited to the amount paid for the services.

Governing Law: This invoice is governed by the laws of [Your State/Country].

Contact: [Your Business Name], [Address], [Phone], [Email].

You can copy this structure into your invoice software or Word document, then edit details based on your needs.

Best Practices for Writing Invoice Terms and Conditions

A template is only effective if written properly. Here are tips to keep in mind:

Keep it simple – Avoid legal jargon. Write in plain language.

Be specific – Dates, percentages, and amounts must be clear.

Stay professional – Polite but firm wording works best.

Adapt per client – Some clients may require customized terms.

Review regularly – Update terms as your business grows.

Common Mistakes to Avoid

Many businesses make errors when drafting invoice terms. Avoid these pitfalls:

Using vague language like “pay soon” instead of “due within 15 days.”

Forgetting to include late fees.

Not mentioning refund or return policies.

Leaving out governing law for international clients.

Making the terms too long or complicated.

Benefits of a Strong Invoice Terms and Conditions Template

Having a well-structured template offers both short-term and long-term benefits:

Faster Payments – Clients know deadlines clearly.

Legal Protection – Reduces disputes and misunderstandings.

Professional Image – Shows you run an organized business.

Better Client Relationships – Transparency builds trust.

Scalability – As your client base grows, you don’t waste time rewriting terms.

Case Example: Freelancer vs. Small Business

Let’s consider two cases:

Case 1: Freelancer Without Terms

A freelance designer sends an invoice but doesn’t include payment deadlines. The client delays payment for three months. The freelancer struggles with cash flow but has no written terms to enforce payment.

Case 2: Small Business With Terms

A small IT company includes clear terms: Net 15 payment, 2% late fee, and delivery responsibilities. When a client delays, they enforce the late fee. Payment arrives quickly, and both parties respect the agreement.

The difference is clear: strong invoice terms protect your income.

How to Customize an Invoice Terms and Conditions Template

Every business is different. Here’s how you can tailor your template:

Freelancers & Consultants – Focus on payment terms, project timelines, and intellectual property rights.

Retail & E-commerce – Highlight return/refund policies and delivery details.

Service Providers – Include cancellation policies and scope of services.

International Businesses – Add currency details, tax information, and governing law.

Quick Checklist Before Sending an Invoice

Before you send your invoice, review these points:

Is the due date mentioned?

Are late fees clearly stated?

Is your refund/return policy included?

Is delivery or service timeline explained?

Did you add your business contact details?

Is the language simple and professional?

Conclusion

An invoice is more than just a payment request. It’s a legal tool that sets expectations and protects your business. By using a well-crafted invoice terms and conditions template, you save time, avoid disputes, and get paid faster.

Start by drafting a simple template, customize it to your business needs, and use it consistently. Over time, this small step will strengthen your professional image and improve your cash flow.

Post Comment