Risk Averse Meaning: What It Really Means and Why It Matters

Have you ever wondered why some people prefer safe investments while others jump at risky opportunities? The difference often comes down to how much risk a person is willing to take. That’s where the term “risk averse” comes in.

Understanding the risk averse meaning is essential not only in finance and investing but also in everyday life. Whether you’re managing money, running a business, or making personal decisions, your attitude toward risk shapes your choices and outcomes.

In this article, we’ll break down what it means to be risk averse, why it matters, how it works in real-world scenarios, and how you can find a healthy balance between safety and opportunity.

What Does Risk Averse Mean?

At its core, being risk averse means preferring certainty over uncertainty.

A risk-averse person avoids taking unnecessary risks and chooses safer options, even if it means receiving smaller rewards. In other words, they value security and stability more than the possibility of high gains that come with high risk.

Simple Example

Imagine two investment options:

Option A: Guaranteed profit of $1,000.

Option B: 50% chance to win $2,500, and 50% chance to win nothing.

A risk-averse person will choose Option A because it’s safe and predictable, even though Option B could potentially earn more money.

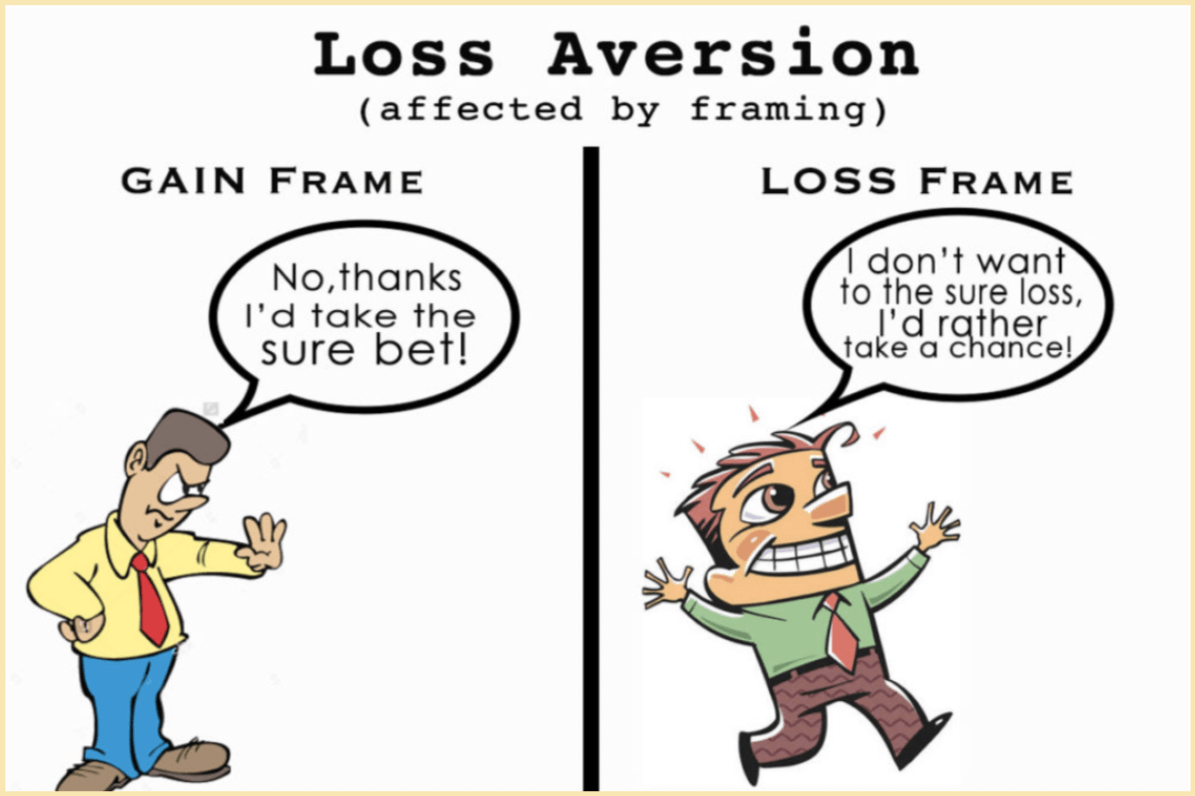

The Psychology Behind Risk Aversion

The risk averse meaning goes beyond just money—it’s rooted in human psychology. People generally fear losses more than they value equivalent gains.

This idea comes from prospect theory, developed by psychologists Daniel Kahneman and Amos Tversky. According to their research, losing $100 feels roughly twice as painful as the joy of gaining $100.

That’s why risk-averse people often avoid situations where they might lose, even if there’s a chance to win big.

Common Traits of Risk-Averse Individuals:

Prefer steady returns over high but uncertain gains.

Focus on long-term stability.

Avoid impulsive or speculative decisions.

Feel discomfort with uncertainty or volatility.

Risk Averse Meaning in Finance and Investing

In finance, risk aversion plays a major role in shaping investment decisions.

Investors who are risk averse prefer low-risk investments such as:

Government bonds

Fixed deposits (FDs)

Index funds or blue-chip stocks

High-quality corporate bonds

They avoid or limit exposure to volatile assets like cryptocurrencies, penny stocks, or startups.

Example in Investing

Suppose an investor has $10,000:

A risk-averse investor might put it in a government bond with a guaranteed 4% return.

A risk-tolerant investor might buy shares in a new tech startup that could either double or lose half its value.

The difference shows how comfort with risk influences where people invest their money.

Risk Aversion in Business Decisions

Business leaders also deal with risk every day—launching a new product, entering new markets, or changing strategies.

A risk-averse business might:

Stick to proven products rather than innovating.

Avoid expanding into new countries or industries.

Prioritize maintaining profit margins over rapid growth.

While this cautious approach protects against big losses, it can also limit potential rewards or innovation.

Example:

Kodak, once a photography giant, hesitated to fully adopt digital technology because of fear of risk. That decision allowed competitors to take over the digital camera market.

So, being too risk averse can sometimes lead to missed opportunities.

Risk Averse vs. Risk Tolerant vs. Risk Seeking

To better understand the risk averse meaning, it helps to compare it with the opposite attitudes toward risk.

| Type | Definition | Behavior Example |

|---|---|---|

| Risk Averse | Prefers safety and certainty | Chooses fixed returns over uncertain profits |

| Risk Tolerant | Accepts moderate risk for higher rewards | Invests in balanced mutual funds |

| Risk Seeking | Enjoys taking high risks for high potential returns | Invests in volatile startups or cryptocurrencies |

Most people fall somewhere between risk averse and risk seeking, adjusting their choices based on goals, age, or financial situation.

Risk Aversion in Economics

In economics, the risk averse meaning has a mathematical aspect. Economists use utility theory to measure how much satisfaction or “utility” a person gets from different outcomes.

A risk-averse person’s utility curve is concave, meaning that each additional dollar provides less satisfaction. So, they’d rather have a smaller certain amount than a risky amount with the same expected value.

Example:

Receiving a guaranteed $100 might feel better to a risk-averse person than having a 50% chance to win $200.

This concept helps economists and policymakers understand consumer behavior, insurance demand, and investment patterns.

Risk Aversion in Everyday Life

Risk aversion isn’t limited to money—it shows up in everyday choices too.

Examples in Daily Life:

Choosing a stable 9–5 job over a startup venture.

Buying health or car insurance for peace of mind.

Avoiding extreme sports like skydiving or mountain climbing.

Following a predictable routine rather than trying something new.

While these choices protect from loss, they can also limit personal growth if fear of risk becomes too strong.

Benefits of Being Risk Averse

Being risk averse has several advantages, especially in uncertain or volatile environments.

Financial Stability

Choosing safer investments ensures more consistent returns and helps protect capital during market downturns.

Peace of Mind

Knowing your money or decisions are safe reduces stress and anxiety.

Long-Term Security

Risk-averse strategies often focus on sustainable, steady growth rather than quick wins.

Lower Chance of Loss

By avoiding risky decisions, individuals are less likely to face big financial or emotional setbacks.

Drawbacks of Being Too Risk Averse

However, being overly cautious can also create problems.

Missed Opportunities

Avoiding all risk may cause you to miss out on high-reward opportunities like emerging markets or innovative ventures.

Low Returns

Safe investments usually offer smaller returns, which might not keep up with inflation over time.

Limited Personal or Business Growth

Avoiding risk can prevent you from exploring new ideas, careers, or investments that could lead to success.

Overdependence on Safety

Relying too much on guaranteed outcomes can make adapting to change harder.

Finding the Right Balance

The key is not to eliminate risk—but to manage it wisely.

Tips to Balance Risk and Reward:

Know Your Risk Tolerance:

Understand how much uncertainty you can handle without losing sleep.

Diversify Investments:

Spread your money across different assets (stocks, bonds, real estate) to reduce risk.

Start Small:

If you’re uncomfortable with risk, take small steps toward riskier opportunities to build confidence.

Think Long-Term:

Focus on consistent growth instead of short-term market movements.

Stay Informed:

Educate yourself about financial markets or business trends before making decisions.

By balancing caution with calculated risks, you can protect yourself while still achieving growth.

Real-World Example: Warren Buffett’s Balanced Approach

Investor Warren Buffett is often considered risk averse, but not in a limiting way.

He avoids speculative investments, preferring companies with strong fundamentals. Yet, he also takes calculated risks when opportunities arise—like investing in Apple or Coca-Cola early.

Buffett’s strategy shows that being risk averse doesn’t mean avoiding all risk—it means understanding and managing it intelligently.

How to Assess Your Risk Aversion Level

If you’re unsure where you stand, here are a few questions to help you find out:

How do you feel when your investment loses value temporarily?

Would you prefer a steady 5% return or a 50% chance of earning 10%?

Do you prioritize security over potential growth?

How comfortable are you with uncertainty in general?

Your answers can help determine whether you are risk averse, risk neutral, or risk seeking.

Key Takeaways

The risk averse meaning refers to preferring safety and certainty over high-risk, high-reward outcomes.

Risk aversion is driven by psychology, especially the fear of loss.

In finance, risk-averse investors choose safer options like bonds or index funds.

While caution can protect you, too much of it can limit growth.

The best strategy is to balance risk and reward through knowledge, diversification, and self-awareness.

Conclusion: Embrace Smart Risk Management

Being risk averse isn’t a flaw—it’s a personality trait that protects you from unnecessary losses. But in today’s fast-changing world, learning to take calculated risks is equally important.

Whether in finance, business, or personal life, the goal isn’t to avoid risk completely—it’s to understand it, manage it, and make it work in your favor.

So, the next time you face a big decision, ask yourself: Am I being cautious for safety—or am I missing an opportunity because of fear?

Finding that balance is the key to long-term success and peace of mind.

Post Comment